Next

About Us

The Center for Innovative Enterprise Law (CIEL) is the first legal research center in Asia to promote integrated and cross-disciplinary research on innovative legal institutions governing business, enterprises and the market. Established as a university-level research center, the CIEL aims to raise the quality and level of legal research in Taiwan, impact on public policies, and promote research output to the world. As the name suggests in French, the sky is our limit.

News

2026.01.21

NewsCIEL Deputy Director Yang Yueh-Ping’s Featured Lecture|Transparency of Legal Person and Legal Arrangements

On January 21, 2026, CIEL Deputy Director Professor @ Yueh-Ping Yang was invited to speak at the 17th Anti-Money Laundering and Anti-Financial Crime Conference—Taiwan, hosted by the Association of Certified Anti-Money Laundering Specialists (ACAMS). In his featured lecture, titled “Transparency of Legal Persons and Legal Arrangements,” Professor Yang examined the central role of the beneficial ownership regime within the anti-money laundering framework, drawing on international standards and Taiwan’s current legal system.

Professor Yang first outlined the requirements under Recommendations 24 and 25 of the FATF Recommendations concerning beneficial ownership for legal persons and legal arrangements. He emphasized that the FATF calls on jurisdictions to ensure that competent authorities can obtain beneficial ownership information on legal persons and legal arrangements swiftly and effectively, and to adopt effective measures to prevent the misuse of nominee shareholders or nominee directors for money laundering or terrorist financing.

Turning to Taiwan’s legal framework, Professor Yang referenced Article 22-1 of the Company Act and Article 11 of the Money Laundering Control Act, noting that while the current system imposes reporting and record-keeping obligations for certain company information and for some trustees, Taiwan still relies heavily on financial institutions and DNFBPs to identify beneficial owners. A comprehensive system for the reporting and centralized access to beneficial ownership information has yet to be fully established. Significant transparency gaps also remain with respect to nominee shareholders/directors, legal persons other than companies, and legal arrangements other than trusts.

By comparing international AML standards with Taiwan’s existing legal framework and regulatory practices, the lecture identified key areas where further reforms are needed to enhance the transparency of legal persons and legal arrangements, and offered important policy and legislative insights for strengthening Taiwan’s anti-money laundering and counter-financial crime regime.

2026.01.02

NewsCIEL Deputy Director Yueh-Ping Yang — Research Publication|Control and Ownership of Digital Assets: Taiwan

In January 2026, CIEL Deputy Director Professor @Yueh-Ping (Alex) Yang co-authored the book chapter “Control and Ownership of Digital Assets: Taiwan” with Professor Meng-Shiang Lin of Ming Chuan University. It is included in Control and Ownership of Digital Assets, edited by Mirjam Eggen, Linda Jeng, and Sebastian Omlor.

Legal Characterization of Virtual Assets under Civil Law: The Trend toward Personal Property

- Legal characterization: Although Taiwan has not yet enacted a special private law statute governing virtual assets, judicial practice has gradually formed a consensus characterizing virtual assets as personal property under the Civil Code.

- Determination of possession: Courts tend to regard the actual knowledge of private keys or seed phrases as the core criterion for establishing actual control and powers of disposition. This approach is broadly consistent with the UNIDROIT Principles on Digital Assets and Private Law.

Custodial Relationships and Allocation of Rights: Application of the Deposit Contract

- Legal relationship: Where traders hold virtual assets through custodians, current regulations and court decisions generally characterize the relationship between customers and custodians as a deposit contract under the Civil Code.

- Ownership attribution: Under Taiwan’s Virtual Asset Service Provider (VASP) registration regime, enacted in 2024, ownership of the virtual assets remains with the customer, while the custodian is deemed the direct possessor. The customer retains the status of indirect possessor and holds a right to request the return of their virtual asset.

Limits of the Personal Property Framework and the Proposed Ledger-Based Approach

- Doctrinal debate: While Taiwanese courts tend to classify virtual assets as personal property, a majority of scholars conceptualize virtual assets as intangible property rights.

- Challenges of publicity: Defining “possession” by reference to the knowledge of private keys or seed phrases fails to generate the level of publicity and observability traditionally required for possession under property law.

- Legislative proposal: The chapter suggests that the transfer and publicity of rights in virtual assets would be better grounded in a ledger-based system, using distributed ledger records as the basis for rights attribution, thereby addressing the deficiencies in publicity and reliability associated with key-based control.

This research not only presents the current state of Taiwan’s private law framework for virtual assets, but also proposes forward-looking institutional designs that may inform future legislation and judicial practice. The information of the book is as follows: https://www.mohrsiebeck.com/en/book/control-and-ownership-of-digital-assets-9783162001344/.

CIEL will continue to engage with the intersection of virtual assets, financial technology, and private law, fostering in-depth dialogue and international collaboration in emerging areas of technology law.

2025.12.20

NewsCIEL Deputy Director Yueh-Ping Yang Invited to the Conference “Major Constitutional Challenges in the AI Era”

On December 20, 2025, CIEL Deputy Director Professor @Yueh-Ping (Alex) Yang was invited to attend the conference “Major Constitutional Challenges in the AI Era,” hosted by the ROC Constitutional Law Society. Professor Yang delivered a speech entitled “AI Discrimination and Explainable AI: Focusing on AI Credits,” offering an in-depth analysis of how AI-driven decisions affect financial fairness and how law and technology can work together to respond to these challenges.

Professor Yang first introduced the provisions on AI fairness set out in the Financial Supervisory Commission’s Guidelines for Artificial Intelligence (AI) Applications in the Financial Industry. He emphasized that “fairness” does not mean uniform equality or the absence of differential treatment, but rather differential treatment with legitimate justification. The key issue lies in whether such differential treatment is grounded on reasonableness and whether it results in systematic adverse impacts on specific groups with reasonable grounds.

Professor Yang further noted that while AI entails risks of discrimination, a more comprehensive understanding is that AI “may be more fair than humans, yet also more discriminatory.” The fundamental risk of AI stems from its “black box” decision-making process, and Explainable Artificial Intelligence (XAI) can play a critical role in addressing this challenge. Through techniques such as SHAP, LIME, and counterfactual explanations, financial institutions can analyze the key variables used in AI-driven decisions and the influence of individual variables on outcomes, thereby assessing whether protected characteristics are being used and whether such use can be justified.

In conclusion, Professor Yang proposed the “relative black box theory,” arguing that the integration of AI with XAI does not necessarily exacerbate discrimination, but may instead facilitate more objective solutions. Nevertheless, this approach requires supporting legal frameworks, including clearly defined protected groups in relevant legislation, permitting the use of protected characteristics for testing purposes, and empowering regulators to establish acceptable thresholds for differential treatment.

CIEL will continue to closely monitor the interaction between the evolution of AI technologies and the rule of law, promote financial fairness and justice in the digital age, and contribute to the development of a more resilient and transparent AI regulatory framework in Taiwan.

2025.11.25

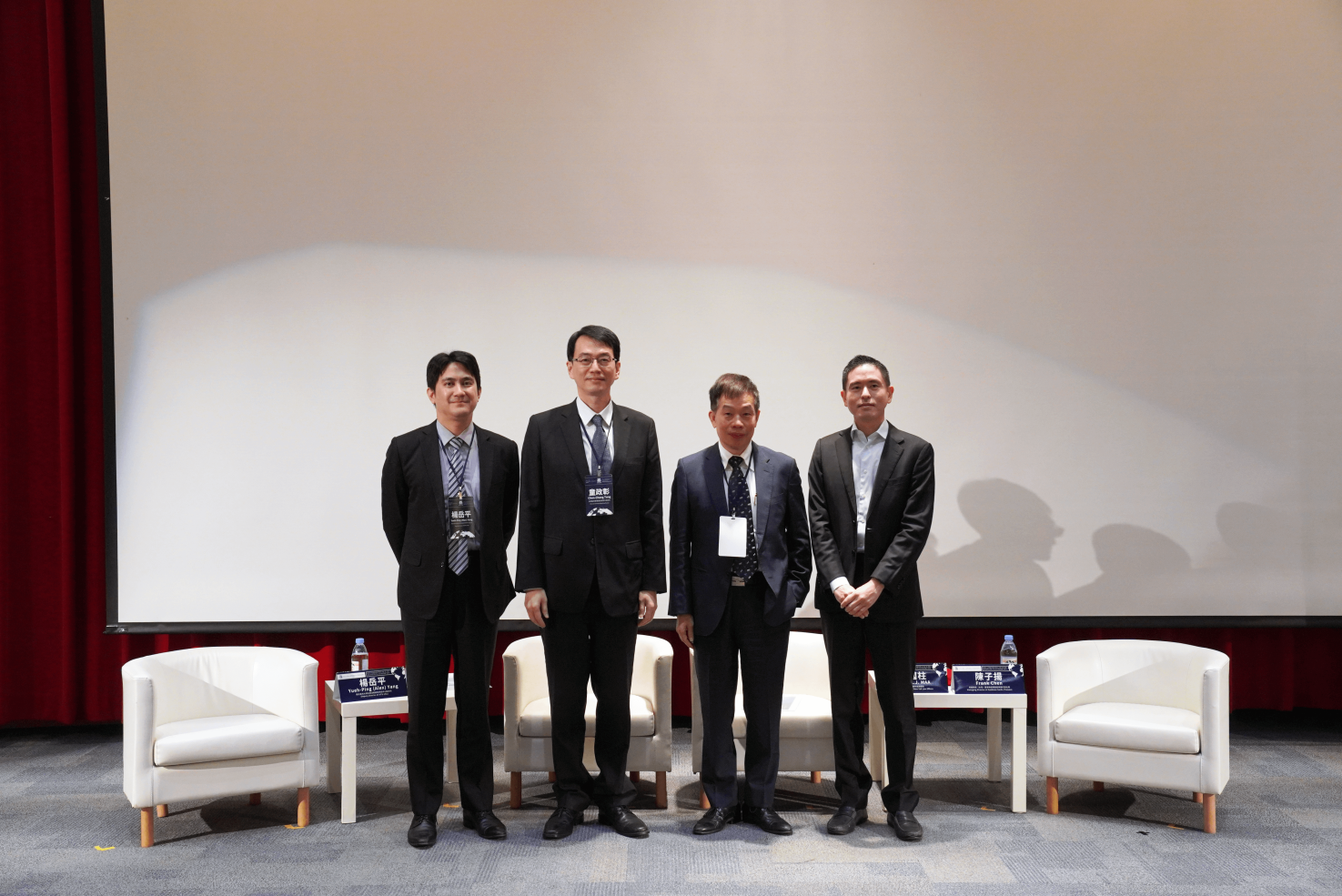

NewsCIEL Director Professor Wang-Ruu Tseng and Deputy Director Professor Yueh-Ping Yang Invited to Attend FSC Public Hearing

On July 31, 2025, Professor Wang-Ruu Tseng, Director of the Center for Innovative Legal and Economic Institutions (CIEL) at National Taiwan University, and Professor Yueh-Ping Yang, Deputy Director of CIEL, were invited by the Financial Supervisory Commission (FSC) to attend a public hearing on the draft amendments to the Regulations Governing the Investing Activities of a Financial Holding Company. At the hearing, they offered expert insights on key aspects of the proposed revisions, drawing on both academic research and practical experience.

The proposed amendments were initiated by the FSC in response to recent trends in financial sector consolidation and were formulated with reference to both domestic and international merger and acquisition practices. The primary objective of the revisions is to better align the regulatory framework with market realities while strengthening market order and corporate governance. During the hearing, scholars and industry representatives engaged in in-depth discussions on several critical issues, including adjustments to the shareholding thresholds for initial investments, the requirements for non-consensual mergers and the submission of feasibility plans, restrictions on consideration methods in tender offers, disclosure requirements, and the roles of boards of directors and audit committees in investment decision-making processes.

The FSC further explained that the amendments seek to reaffirm the statutory concept of controlling shareholdings under the Financial Holding Company Act while reducing regulatory uncertainty in merger and acquisition transactions. Key measures include clarifying documentation requirements for initial investments, allowing adjustment periods for the dual leverage ratio (DLR), and incorporating opinions from independent experts and audit committees to enhance the quality and procedural integrity of board decisions. In addition, the amendments regulate the timing of tender offer disclosures to prevent unnecessary market volatility prior to regulatory approval, thereby safeguarding market stability and shareholder interests.

Several recommendations raised during the public hearing by academic and industry participants were subsequently incorporated into the final amendments officially announced by the FSC on November 25, 2025. This reflects the FSC’s commitment to an inclusive consultation process and its efforts to strike an appropriate balance between regulatory oversight, market flexibility, and sound corporate governance.

CIEL has long been dedicated to the study of financial regulation and corporate governance. Going forward, the Center will continue to engage in public policy discussions and contribute academic and practical perspectives to support the development of a more transparent, resilient, and forward-looking legal framework for financial mergers and investment management.

the officially promulgated amendments

Regulations Governing the Investing Activities of a Financial Holding Company

2025.11.13

NewsCIEL Deputy Director Prof. Yueh-Ping Yang Invited to Attend the 2025 International Forum on Virtual Asset Crimes Investigation and Cross-Border Cooperation

On November 13, 2025, CIEL Deputy Director Professor Yueh-Ping (Alex) Yang was invited to attend the “International Forum on Virtual Asset Crimes Investigation and Cross-Border Cooperation,” hosted by the Anti-Money Laundering Office, Executive Yuan. The forum brought together expert representatives from domestic and international government agencies to engage in in-depth discussions on topics including tracking illicit virtual asset flows, combating online fraud, and strengthening cross-border cooperation.

Deputy Director Yang served as a panelist in the session titled “Stablecoins and Chinese Web: Money Laundering and Clearing Services between Digital Asset and FIAT.” The session featured keynote presentations by Mathieu H. L. and Simon Roch from FIU France. From legal and regulatory perspectives, Deputy Director Yang highlighted the following key points:

- Traditional financial crime investigations have focused on monitoring money flows; however, in the era of digital finance, the boundary between money flows and data flows is increasingly blurred, calling for a rethinking of crime prevention strategies.

- In virtual asset–related crimes, the key points for investigation may be shifting from unregulated OTCs to unregulated decentralized finance (DeFi).

- Within DeFi ecosystems, SNS platforms, such as Telegram or Wechat, play a critical role in facilitating communication and coordination. Future criminal investigations should therefore extend beyond regulating financial intermediaries (e.g., VASPs) to also consider the role of digital platform service providers.

CIEL will continue to engage in international exchanges and work alongside government authorities and law enforcement agencies to advance the development of financial regulation and crime prevention frameworks for virtual assets.

2025.09.30

NewsDeputy Director Chao-Hung Chen Publishes New Research“Carbon Emission Disclosure and Greenwashing Risk in the Capital Market”

How corporations disclose their carbon emissions information has become a crucial issue for corporate governance and in the capital market in recent years. In September 2025, CIEL Deputy Director and Associate Professor Chao-Hung Chen published an article titled “Carbon Emission Disclosure and Greenwashing Risk in the Capital Market” in the NTU Law Journal.

Professor Chen ‘s study examines the disclosure practices of publicly listed companies in Taiwan regarding their GHG emissions between 2011 and 2021. While the article agrees that disclosure is an important tool to promote carbon reduction, the study suggest that the effectiveness of carbon disclosure must depend on whether the information disclosed is accurate, comprehensive, and comparable to offer useful data to the market.

Highlights:

- Limited effectiveness voluntary disclosure — Few companies disclosed their carbon emission data voluntarily before mandatory rules took effect, supporting the move toward a mandatory disclosure regime.

- Fragmented and inconsistent content — Disclosure statements were often brief and inconsistent in format and content. Much information lacked third-party verification, showing signs of selective or incomplete reporting.

- Significant greenwashing risk — Many firms relied on vague qualitative descriptions rather than concrete quantitative data, making it difficult for investors and regulators to assess real carbon reduction outcome.

Professor Chen emphasizes that regulators should strike a balance between lowering disclosure costs and enhancing the substance of disclosure as well as to establish quantifiable data over time in order to strengthen the credibility and market value of ESG information.

Abstract:https://acrobat.adobe.com/id/urn:aaid:sc:ap:8c85c7c9-e28a-47a4-b0e5-34efa25e0477

2025.09.11

NewsProfessor Chao-Hung Chen Awarded NSTC Grant for Three-Year Research on Tokenization and Legal Infrastructure

Professor Chao-Hung Chen, Deputy Director of the Center for Innovative Enterprise Law (CIEL) at National Taiwan University, has recently been awarded a three-year research grant by the National Science and Technology Council (NSTC), recognizing his academic contributions and research potential in the fields of fintech and digital asset regulation.

.

The approved research project, titled “A Study on the Tokenization of Financial Markets and Its Legal Infrastructure”, will run from 2025 to 2028. The study will focus on the transformative potential of tokenization in reshaping the structure of existing capital markets and explore the legal infrastructure required to support such transformation. The project not only continues the Center’s commitment to the development of digital financial regulation but also builds on the key themes highlighted in CIEL’s 2024 salon.

.

As fintech and digital assets increasingly converge, designing a legal framework that balances innovation with risk management has become a critical issue for global research and policy agendas. Through this project, CIEL aims to further strengthen its position at the forefront of digital financial law research and to provide concrete policy recommendations for Taiwan’s future regulatory design. The Center also intends to share the project’s findings and progress on public platforms, fostering dialogue between academia and practice.

2025.09.11

NewsDeputy Director Yueh-Ping Yang was invited as a Speaker at the“IADI Core Principles International Conference”

In September 11, 2025, at the “IADI Core Principles International Conference” held in Taiwan by the International Association of Deposit Insurers (IADI).CIEL Deputy Director Professor Yueh-Ping (Alex) Yang was invited to serve as a panelist, sharing on the topic of “The Impact of Digital Financial Innovation on the Deposit Insurance System.”

This session focused on whether emerging financial instruments such as electronic payments, stablecoins, and deposit tokens should be covered by deposit insurance. From an academic perspective, Deputy Director Yang proposed three key criteria for the assessment: liquidity risk, contagion risk, and the money creation function, which sparked enthusiastic responses and in-depth discussions among representatives from various countries.

IADI is an international standard-setting body for deposit insurance systems, and Taiwan’s Central Deposit Insurance Corporation is IADI’s formal member. This year’s conference, held in Taiwan, comes at a significant moment for the revision of IADI’s Core Principles since 2014, and coincides with the 40th anniversary of the Central Deposit Insurance Corporation, giving it profound significance.

2025.08.21

NewsDeputy Director Yueh-Ping Yang Invited to the “2025 Cathay Financial Holdings Digital Asset Trends Forum” as Moderator and Panelist

On August 21, 2025, CIEL Deputy Director Professor Yueh-Ping Yang was invited by Cathay Financial Holdings to attend the “2025 Cathay Financial Holdings Digital Asset Trends Forum,” where he served as both a moderator and a panelist. Drawing on perspectives from law and financial regulation, Professor Yang provided an in-depth analysis of the institutional challenges and policy issues arising from the development of digital assets.

This forum marked the first large-scale public forum on digital asset–related topics organized by a domestic financial institution in Taiwan. Director Brenda Hu and Deputy Director Yi-Chun Shih of the Financial Supervisory Commission’s Department of Development and Innovation were also invited to deliver keynote speeches and participate in panel discussions. Following the forum, Cathay Financial Holdings released the “Digital Asset Trends Insights” report, to which Professor Yang contributed a column sharing his research perspectives and policy recommendations.

Professor Yang’s participation in the forum focused on two key sessions:

1. As a panelist in the session “Innovation in Virtual Asset Custody Services and Anti-Money Laundering,” Professor Yang offered a comparative analysis of domestic and international legal frameworks, highlighting the strategic importance of virtual asset custody services in financial institutions’ expansion into related businesses. He further examined the respective institutional roles and comparative advantages of financial institutions and virtual asset service providers (VASPs) in the area of custody services.

2. As the moderator of the session “Regulatory Considerations and Future Challenges for Financial Institutions Operating VASP Businesses,” Professor Yang facilitated dialogue among perspectives on digital financial business development, regulatory compliance practices, and external financial supervision. The discussion explored priority areas for financial institutions in developing virtual asset businesses, the corresponding internal control and risk management mechanisms required, and expectations regarding financial laws and regulatory frameworks.

The forum focused on key topics including real-world asset tokenization (RWA), stablecoins, and virtual asset custody, and brought together financial institutions, domestic and international industry representatives, and regulatory authorities to engage in substantive discussions on future trends and institutional design in the digital asset market. Professor Yang’s participation underscores CIEL’s long-standing commitment to research in digital financial law and its continued role in bridging academia, public policy, and industry practice.

Forum video website: https://reurl.cc/8bZ7Yy

Digital Asset Trends Insights report: https://reurl.cc/W8ZWb9

2025.07.31

NewsCIEL Experts Provide Insights on Draft Amendments to the Financial Holding Company Investment Regulations

In July 2025, Professor Wang-Ruu Tseng, Director of the Center for Innovative Enterprise Law (CIEL), and Professor Yueh-Ping Yang, Deputy Director, were invited by the Financial Supervisory Commission (FSC) to attend a public hearing on the draft amendments to the Regulations Governing the Investment of Financial Holding Companies, where they provided professional insights on the key revisions.

.

Since its promulgation in December 2010, the Regulations have undergone two amendments, the most recent in May 2022. The current draft represents a comprehensive revision, expanding the provisions from 12 to 13 articles. The main directions include:

-

Strengthening rules governing investment activities of financial holding companies while moderately relaxing financial leverage requirements, balancing institutional stability and market order.

-

Adding corporate governance requirements for investment decision-making, such as requiring the first investment case of a financial holding company to be reviewed by the audit committee and assessed by external independent experts, in order to protect shareholder rights and ensure prudent decision-making.

-

Clarifying the required documents for investment applications, disclosure of tender offer conditions, and restrictions on reapplications.

.

The hearing gathered opinions from scholars and experts with the aim of ensuring that the legal framework balances flexibility and transparency in financial holding company mergers and investments, while enhancing overall market governance. CIEL will continue to monitor the evolution of related regulations and promote the development of a sound financial legal environment.

Next

Events and Announcements

2025.12.15

Events2025 Enterprise Law Innovation Salon|Highlights of Sessions II & III

The second session, titled “Infrastructure Development and Regulatory Challenges of Emerging Payment Instruments,” was moderated by Deputy Director Chao-Hung Chen of CIEL. The panel featured Kuo-Liang Lin, Chairperson of the Financial Information Service Co.; Quincy Chen, Chief Digital Officer of Cathay United Bank; and Darren Wang, Founder of the OwlTing Group. Drawing on perspectives from financial market infrastructure, banking practice, and startup experience, the panel examined the institutional challenges and future possibilities arising from innovations in payment systems.

Founder Wang shared his experience with cross-border stablecoin applications, noting that while stablecoins offer clear advantages in improving the efficiency and immediacy of cross-border remittances, significant challenges remain, including compliance procedures, anti-money laundering (AML) requirements, cross-chain settlement, and fiat currency conversion. Chairperson Lin observed from a financial infrastructure perspective that the evolution of payment instruments is fundamentally a process of continuous digitalization, and that the potential of stablecoins to enhance settlement speed and efficiency represents a trend that existing systems must directly address. From a banking perspective, CDO Chen emphasized that customers place the highest priority on immediacy, stability, and uninterrupted service—particularly in corporate and cross-border financial contexts. While blockchain and stablecoins offer efficiency gains, he noted that their adoption must proceed cautiously within sound risk management and compliance frameworks.

The third session, titled “Infrastructure Development and Regulatory Challenges of AI in Finance,” was moderated by Chief Executive Officer Chung-Chia Huang of CIEL. The panel featured Yi-Chun Shih, Deputy Director of the Department of Development and Innovation, Financial Supervisory Commission; Tzu-Hsiung Wang, Director at the Science and Technology Law Institute; and Shih-Ming Lo, Chief Compliance Officer at HSBC Taiwan. The discussion focused on the practical applications of artificial intelligence in finance, as well as the associated regulatory and institutional challenges.

During the discussion, CCO Lo noted that financial institutions currently rely primarily on machine learning, which is widely applied to internal process optimization, customer service and wealth management chatbots, as well as AML and fraud prevention. He emphasized that model explainability and continuous validation remain indispensable. Deputy Director Shih explained that AI is also being applied in areas such as credit analysis, underwriting and claims processing, and investment management. However, due to risks associated with generative AI—including hallucinations, inaccuracies, and personal data protection concerns—its current use is largely limited to internal support functions. Regulators have therefore adopted a guidance-first, risk-based supervisory approach. Director Wang highlighted that financial institutions’ heavy reliance on third-party suppliers for AI development may give rise to concentration and single-point-of-failure risks, underscoring the need for institutional design to balance outsourcing management with operational resilience.

Discussions in Sessions II and III concluded successfully, with each session focusing on two critical fintech themes—payment innovation and artificial intelligence—while showcasing diverse perspectives from government, industry, and academia on infrastructure development, regulatory flexibility, and risk governance. Building on the valuable insights shared by the panelists, CIEL will continue to advance its research efforts with the aim of contributing concretely to the future development of legal and regulatory frameworks.

2025.12.15

Events2025 Enterprise Law Innovation Salon|Highlights of Session I

On December 15, 2025, CIEL hosted the 2025 Enterprise Law Innovation Salon, bringing together representatives from government, industry, and academia to engage in dialogue on key topics including real-world assets (RWA), cross-border payments, stablecoins, and artificial intelligence. The salon opened with welcoming remarks by Professor Wang-Ruu Tseng, Vice President of National Taiwan University and Director of CIEL. Professor Tseng emphasized that a central purpose of the salon was to shape the Center’s research agenda for the coming year through cross-sector exchange. She further expressed the expectation that financial regulatory authorities, in the course of policy formation, could draw on international practices by establishing advisory committees, issuing policy white papers, and conducting public consultations. Such mechanisms, she noted, would enable deeper regulatory research and facilitate open dialogue with industry, thereby enhancing the professionalism, transparency, and market responsiveness of regulatory frameworks.

The opening session continued with remarks by Chairperson Jin-Lung Peng of the Financial Supervisory Commission. Chairperson Peng affirmed the salon’s focus on the regulation of financial market infrastructure and shared the regulator’s overarching supervisory approach to real-world assets, emerging payment instruments, and artificial intelligence. He underscored the guiding principle of “neither rushing ahead nor falling behind,” under which pilot programs and institutional discussions should be advanced in a measured and orderly manner. Using a basketball analogy, Chairperson Peng illustrated the complex relationship between industry development and rule-making, observing that many fintech innovations require the prior establishment of legal frameworks and foundational institutions in order to develop smoothly. His remarks highlighted the critical importance of legal and institutional innovation. Chairperson Peng concluded by reaffirming the significance of CIEL’s establishment and recognizing the Center’s role and contributions in advancing research on financial regulation and innovation.

Following the remarks by the two distinguished guests, Session I of the salon formally commenced. The first session, titled “Infrastructure Development and Regulatory Challenges of Real-World Assets,” was moderated by Deputy Director Yang. The panel featured Zhong-Hao Huang, Deputy Director General of the Securities and Futures Bureau (SFB) ; Hui-Hua Pai, Director of Legal Affairs and Compliance at the Taiwan Depository and Clearing Corporation (TDCC); and Hung-Chih Chen, Project Manager at the Bank of Taiwan. The panel explored the development of RWA infrastructure and the associated practical challenges from regulatory, financial market infrastructure, and banking perspectives.

During the session, Deputy Director General Huang outlined the SFB’s regulatory planning for security-token RWA, addressing potential supervisory issues across various stages, including the legal characterization of property rights, issuance and reissuance, over-the-counter trading, custody, and settlement. He also provided a comparative assessment of different blockchain architectures and their respective advantages and limitations. Director Pai drew on the TDCC’s experimental work with security-token RWA to highlight potential civil law property issues, such as the applicability of enforcement, liquidation, and inheritance regimes to tokenized securities. She further explained the role that the TDCC could play in bridging on-chain and off-chain systems, enabling investors to access securities recorded under different ledger structures. Project Manager Chen shared insights from the Bank of Taiwan’s ongoing gold RWA project, illustrating the practical impact of RWA on clearing, settlement, and the optimization of financial market infrastructure, while also identifying emerging challenges related to competition from non-bank entities, personal data protection, anti-money laundering compliance, and asset exit mechanisms.

The discussion in Session I concluded successfully. Looking ahead, CIEL will continue to facilitate dialogue among academia, practitioners, and regulatory authorities through conferences and industry salons, providing an important foundation for future research and institutional development.

2025.12.13

EventsCenter for Innovative Enterprise Law (CIEL) Co- organizer the “2025 Asia-Pacific Trusts Law Symposium”

On December 12 and 13, 2025, NTU CIEL co- organized the 4th Asia-Pacific Trusts Law Symposium. This symposium serves as a vital biennial meeting for the “Asia-Pacific Trusts Law” book series project. Following previous editions held at the University of Melbourne, Seoul National University, and the University of Tokyo, this year’s event was organized and hosted by Professor Yueh-Ping Yang, Deputy Director of CIEL, at the NTU College of Law.

The Asia-Pacific Trusts Law Symposium is a long-standing international academic research network. It brings together trust law scholars from Australia, New Zealand, Japan, South Korea, Hong Kong, Macau, China, Singapore, Thailand, India, the United States, and Taiwan. The network’s core mission is to conduct in-depth discussions to compare trust law developments across the Asia-Pacific region and to facilitate the publication of scholarly research. To date, the research group has published three volumes covering fundamental trust theories, comparative legal systems, and diverse practical applications. Continuing this publication-oriented model, this year’s symposium featured intensive sessions where each paper underwent rigorous Q&A, fostering substantive dialogue between Common Law and Civil Law jurisdictions regarding the core concepts of the trust system.

The two-day symposium covered a wide array of topics, including civil trusts, commercial trusts, charitable trusts, investment trusts, family trusts, elder care trusts, and offshore trusts. Professor Yueh-Ping Yang, Deputy Director of CIEL, co-presented a paper titled “Organising REITs in Asia” alongside Professor Kelvin Low (University of Hong Kong), Professor Mutsuhiko Yukioka (University of Tokyo), and Professor Jianbo Lou (Peking University). The presentation compared the regulations and practices of Real Estate Investment Trust (REIT) systems across Japan, Hong Kong, Singapore, Taiwan, and China.

As a co-organizer, CIEL continues to support this cross-jurisdictional and intergenerational academic network. By introducing international research communities to Taiwan and participating in the hosting of academic exchanges, CIEL aims to deepen Taiwan’s international connections in comparative trust law research. Moving forward, CIEL remains committed to international collaboration, promoting dialogue and interaction between Taiwanese legal scholarship and the Asia-Pacific and global academic communities.

2025.11.26

EventsCIEL Event Highlights|Sustainable Finance and Financial Regulation Seminar

On November 26, 2025, CIEL Director, Vice President Wang-Ruu Tseng , delivered the opening remarks at the “Sustainable Finance and Financial Regulation Seminar,” setting the tone for the event. CIEL Deputy Directors Chao-Hung Chen and @Yueh-Ping (Alex) Yang also served as speakers, sharing insights on sustainable finance from the perspectives of legal frameworks, disclosure mechanisms, and regulatory tools.

Deputy Director Chen, presenting on “Indirectly Regulating Corporate Sustainability through Financial Institutions,” highlighted that while using financial institutions to restrict capital flows or influence market participants can achieve policy goals, it also raises challenges regarding legitimacy, legal applicability, costs, and governance. Indirect regulation should complement direct regulation, rather than making financial institutions an overly relied-upon policy instrument.

Deputy Director Yang, in his presentation titled “Reassessing Securities Fraud Regulation through Sustainability Disclosure,” emphasized that most sustainability disclosures are not directly related to securities fraud and are primarily addressed through administrative mechanisms. However, sustainability disclosures provide an opportunity to revisit the distinction between securities fraud and financial misrepresentation rules, as well as the interpretation of several key elements such as materiality, transaction causation, and fraud on the market theory.

The seminar brought together experts from academia, government, and industry to explore sustainable finance from multiple angles. CIEL will continue to actively participate in discussions and research on sustainable finance, working alongside stakeholders to advance a more robust legal and regulatory framework.

2025.11.21

Events2025 Innovative Enterprise Law Seminar|Session Ⅱ Recap

The second session of the seminar was led by Professor Yueh-Ping Yang , Deputy Director of CIEL, with Professor Ying-Hsin Tsai as discussant. The session focuses on “Tokenization of Payment Instruments”. The seminar provided an in-depth analysis of the institutional framework, risks and future regulatory directions of payment tokenization from comparative perspectives.

Operation Models and Risks of Stablecoins

Professor Yang noted that stablecoins share many characteristics with tokenized forms of e-money. Using the distinction between primary and secondary markets, he explained the legal structure of stablecoins: while subscription and redemption in stablecoin’s primary market resemble e-money, stablecoin’s secondary-market circulation is beyond the offeror’s control and more depends on virtual asset service providers. As a result, stablecoin faces new risks in addition to that of e-money in areas such as AML compliance, ledger governance, and price de-pegging.

Global Regulatory Trends: Comparative Observations

Professor Yang further outlined global developments in stablecoin regulation. Jurisdictions such as Japan and Singapore regulate stablecoins under their payment laws, while the EU treats stablecoins as a form of e-money token. The United States, lacking a federal-level payment law, sometimes tend to conceptualize stablecoins as deposit-like products.

Japan’s Regulatory Design and Industry Strategy

Professor Tsai added that Japan pioneered a dedicated legal framework for stablecoins in 2022, placing it at the global forefront. Using JPYC’s yen-denominated stablecoin as an example, she explained that its reserve assets primarily consist of government bonds and cash. She also highlighted how Japanese banks are actively building tokenization infrastructure through the Progmat platform. Nonetheless, tokenization also introduces challenges for banks, including reduced fee income, more complex liquidity management, and diminished control over data.

Regulatory Directions in the Tokenization Era

Professor Tsai emphasized that regardless of stablecoins, deposit tokens, or CBDCs, the core of future payment instruments will remain in the hands of financial institutions and central banks. Payment tokenization compels regulatory frameworks to rethink functionality, risks, and responsibility allocation. As the system continues to evolve, cross-disciplinary collaboration and forward-looking planning will be crucial for Taiwan as it navigates global fintech transformation.

Amid the rapid evolution of global fintech, key questions persist: how can regulatory frameworks balance innovation and stability, and how should they address cross-border supervision challenges brought by new forms of payment instruments? CIEL will continue advancing research in these areas, striving to help shape a forward-looking and resilient legal framework for Taiwan.

2025.11.21

Latest News2025 Corporate Legal Innovation Symposium|Round-Table Forum

The roundtable session was moderated by CIEL CEO Chung-Chia Huang, joined by panelists Deputy Director Chao-Hung Chen, Deputy Director Yueh-Ping Yang, Prof. Ying-Shin Tsai, and Assoc. Prof. Yi-Chen Lai.

Legal Characterization of Tokenization

CEO Chung-Chia Huang opened the discussion by raising a core question: Should the legal nature of tokens be determined by the underlying rights they represent or by the electronic records on the blockchain itself? Deputy Director Chen opined that tokens often sit between claims and property rights, functioning more like “value carriers.” He noted that the current international trend increasingly relies on the concept of “control” to determine ownership. This elevates the role of system operators in identifying and transferring rights. Deputy Director Yang observed that domestic courts tend to treat tokens as movables, while academics consider them intangible assets; the legal categorization remains unsettled. Associate Prof. Lai further reminded the audience that whether tokens possess exclusive control is still unclear—reflecting the ongoing evolution of their legal nature.

Regulatory Adjustments and Tokenized Payment Instruments

On the regulatory front, panelists emphasized the need to consider emerging risks within the existing legal and regulatory framework. Deputy Director Yang explained that if a tokenized payment instrument retains its original functional characteristics, existing regulations may continue to apply. However, when market volatility, ledger unpredictability, or anonymity introduce new risks, regulatory reinforcement becomes necessary. Many jurisdictions regulate stablecoins under frameworks similar to electronic payments, illustrating this approach. He also noted that tokenized payments exert limited impact on monetary policy, as funds ultimately settle back within the banking system.

Cross-Border Finality and AML Challenges

During the open Q&A, participants first asked how to determine finality in cross-border transactions. Deputy Director Yang explained that if a single stablecoin dominates the market, its issuer can define finality within its system. However, in a more diverse market, financial institutions probably can negotiate common principles to define finality through contracts. Globally, two approaches coexist: one relying on the distributed ledger itself as the basis for finality, and another centered on “control,” which is conceptually closer to possession.

Regarding AML, when smart contracts automatically settle transactions to blacklisted addresses, risk allocation often depends on contractual arrangements. However, if blacklist information relies on international databases, information asymmetry may arise—posing an important regulatory challenge for Taiwan.

Global Trends in Tokenization

Finally, audience asked about international use cases and trends for tokenizing financial and non-financial assets. Deputy Director Chen noted that global regulation remains fragmented, with high-value financial assets more likely to be tokenized first. Assoc. Prof. Lai highlighted Japan’s experimentation with lower-value assets—such as alcohol products, GameFi items, and hotel usage rights—to reduce public concerns, suggesting that tokenization may expand gradually from everyday-use scenarios.

CIEL will continue advancing research on RWA, tokenized payment instruments, and Web 3.0 financial regulation. Through interdisciplinary analysis across civil law, criminal law, financial regulation, and international standards, we aim to offer concrete policy recommendations. Our goal is to help Taiwan build a corporate legal framework that balances innovation with stability amid rapid technological and regulatory transformation, while strengthening CIEL’s role as a key platform for industry–government–academia dialogue and legal innovation.

2025.11.21

Events2025 Innovative Enterprise Law Seminar|Session I Recap

The NTU Center for Innovative Enterprise Law (CIEL) commits to overcome the legal challenges faced by enterprises amid rapid technological change and market development. This year’s seminar, themed “Web 3.0 Finance and Regulatory Innovation,” explored the potential impacts of tokenization on asset markets and payment systems, and proposed future directions for Taiwan’s legal and regulatory frameworks.

Session I featured a talk by CIEL Deputy Director Prof. Christopher Chen with Associate Professor Yi-Chen Lai from Tohoku University being the discussant. The session focuses on “Real World Asset (RWA) Tokenization”, with following take-aways:

Legal Foundations of RWA Tokenization: Rights and Value Represented by Tokens

Deputy Director Chen highlights that tokenization of assets follows the long history of using legal instruments to represent underlying assets, rights, or value. To understand legal infrastructure of asset tokenization, one can explore legal techniques applicable to various kinds of securities and instruments that may represent a variety of assets, rights or values. In turn, the nature of underlying assets or values might affect legal underpinnings of ‘real-work assets’ and subsequent issues of transaction design, legal validity, and risk allocation.

Balancing Technological Advantages and Legal Risks

While technological and tokenization of assets may offer some benefits such as transactional efficiency and fractionalization of ownership, Dr Chen cautioned that there could also be new legal issues and challenges facing RWAs that require solution in the future, no matter it is based on private ordering or requires legal clarifications in statutes.

Nuanced Classification of Rights and Its Implications

Dr Chen further examined how assets, rights, or value can be integrated into legal instruments, which in turn determines the liquidity of the assets represented by the token. Building on this, the nature of the rights embodied in an asset token directly affects the applicable legal framework. Whether tokenization should fall within the domain of private autonomy or requires explicit legislative intervention remains an important policy question.

International Insights and Forward-Looking Issues

Deputy Director Chen highlighted that RWA-related law and policy can draw from existing regulatory structures and international developments. Associate Professor Lai noted that practice field in Japan have already conducted pilot projects involving gold, sake, and other assets, raising debates over token legal characterization, asset transfer, and rights enforcement. Assoc. Prof. Lai further posed a thought-provoking question: if RWAs begin to represent personal attributes, identity categories, or other status-related characteristics, what legal issues would arise? This underscores the high malleability of RWAs and the accompanying regulatory uncertainty, reinforcing the importance of sustained research in fintech law.

The session concluded successfully, further reinforcing CIEL’s direction to advancing research on RWA and fintech regulatory frameworks, with the hope of contributing forward-looking insights to Taiwan’s future legal innovation.

2025.11.13

EventsInternational Academic Exchange|Professor Deborah Kay Burand Visits CIEL to Discuss Sustainable Finance and Impact Investing

On November 3, 2025, CIEL had the honor of welcoming Professor Deborah Kay Burand from New York University School of Law (NYU Law) for an academic exchange with CIEL Associate Director Professor Yueh-Ping Yang and Professor Chao-Hung Chen. The discussion focused on key issues surrounding sustainable finance and impact investing.

Linking Sustainable Finance Education and Market Practice

The professors agreed that sustainable finance education should go beyond institutional and regulatory frameworks. A genuine understanding of market mechanisms, transaction structures, and stakeholder motivations is essential to grasp the full picture of sustainable finance. Legal education, therefore, should move beyond a purely doctrinal focus to engage with real-world market practices and cultivate more comprehensive analytical skills.

Challenges in Scaling Impact Investing

As impact investing expands, it faces the risk of drifting away from its original mission. Professor Burand emphasized the importance of addressing “impact risk.” Taking microfinance as an example, she noted that without thoughtful design, it may inadvertently increase burdens on intended beneficiaries. Defining, measuring, and managing such risks remains a shared challenge for both academia and industry.

Opportunities and risks of integrating AI into governance

Professor Burand also shared insights on how international sovereign wealth funds are integrating AI to enhance due diligence, data verification, and consistency monitoring. While AI offers analytical advantages, it is gradually evolving from a supporting tool to a decision-shaping force—posing new governance and accountability challenges for future investment management.

The exchange also highlighted Taiwan’s positioning in sustainable finance research. Professor Burand encouraged CIEL to continue strengthening cross-border collaborations and developing case-based research, enabling Taiwan’s academic contributions to gain greater international visibility. CIEL will continue to expand international engagement, foster interdisciplinary dialogue, and integrate theoretical and practical perspectives to actively shape global conversations and advance the long-term vision of sustainable development.

2025.11.03

EventsInternational Academic Exchange|Professor Florence G’Sell Visits CIEL to Discuss Virtual Asset Regulation and Emerging Trends in AI Integration

On November 3, 2025, CIEL was honored to welcome Professor Florence G’Sell from Stanford Law School for an academic exchange. She engaged in an in-depth dialogue with CIEL Deputy Director Professor Yueh-Ping Yang and Professor Chao-Hung Chen on the current developments of virtual assets, artificial intelligence, and other aspects of digital laws, examined through comparative perspectives from Europe, the United States, and Asia.

🔹 Trends in Virtual Asset Regulation Across Asia

Asian jurisdictions exhibit divergent regulatory approaches to virtual assets. Japan was among the first to establish rules for stablecoins; Singapore adopts a principles-based regulatory model; Hong Kong adopts a comprehensive and rigorous framework; and South Korea continues to show a high level of regulatory attention toward virtual assets. In Taiwan, the government is actively promoting the Virtual Asset Service Act, which covers virtual asset service providers, stablecoins, and other related issues, and it is expected to be submitted to the Legislative Yuan for deliberation.

🔹 Differences in Regulatory Cultures Across Europe, the U.S., and Asia

Europe adopts a rule-based approach with comprehensive regulatory frameworks for virtual assets and artificial intelligence. However, its implementation progresses relatively slowly due to differences among its member states.The United States tends to be market-driven, with a relatively light-touch or deregulatory stance. Asia, by contrast, could be viewed as taking a middle-ground approach between Europe and the U.S., featuring pragmatic and hybrid regulatory strategies that balance flexibility and efficiency—making the region particularly significant for comparative legal studies in this area.

🔹 The Future Integration of Blockchain and AI

The integration of blockchain and AI can be seen as an next-generation model of existing blockchain-smart contract integrations, which has the potential to enhance the capabilities of both technologies. However, it may also introduce greater uncertainty, less explainability, and increased legal liability challenges.

CIEL will continue to closely follow developments in technological innovation and legal governance, foster international academic exchanges and collaboration, and contribute to forward-looking research and policy discussions.

2025.10.27

EventsInternational Academic Exchange|Professor LAU Kwan Ho from Singapore Management University Visits CIEL to Discuss International Commercial Dispute Resolution

On October 27, 2025, CIEL was honored to host Professor LAU Kwan Ho from the School of Law at Singapore Management University, who visited the Center for an in-depth dialogue with CIEL Deputy Director Professor Yang Yue-Ping.

This exchange focused primarily on several observations regarding the legal frameworks for international commercial dispute resolution.

Developments and Challenges in International Commercial Dispute Resolution

The two professors first exchanged insights on the experiences of Singapore and Taiwan in promoting mechanisms for international commercial dispute resolution. Their discussion covered the challenges currently faced by the Singapore International Commercial Court and the underlying causes, further extending to the importance of enforceability in international commercial dispute resolution.

Geopolitical Confrontations and New Challenges in International Commercial Dispute Resolution

Against the backdrop of global geopolitical tensions and supply chain restructuring, the two professors discussed how geopolitics may affect international commercial dispute resolution — including the types of commercial disputes arising from economic sanctions and the potential impact of political antagonism on specific issues of international commercial arbitration, such as the appointment of arbitrators.

CIEL will continue to closely follow developments in international commercial law and dispute resolution and foster the dialogues between different jurisdictions and regions.

Prev

Next